Artificial Intelligence (AI) has been a buzzword in the financial industry for quite some time now. With advancements in technology, AI is revolutionizing how financial services are delivered and consumed. From automating mundane tasks to predicting market trends, AI is transforming the finance sector in ways that were unimaginable just a few years ago.

However, with great opportunities come great challenges. Integrating AI in finance brings about ethical considerations, risks, and the need for collaboration between humans and machines. In this blog post, we will explore the various opportunities and challenges of AI skill in finance, its impact on financial advisors, and how it is being applied across different sectors. We will also discuss the benefits and risks of using AI in wealth management, and how the financial industry can prepare for its adoption. Lastly, we will look at future trends and developments in AI in finance, along with real-life case studies of its implementation.

Contents

- 1 How AI in Finance is Revolutionizing

- 2 The Impact of AI on finance

- 3 Ethical Considerations in AI-Driven Finance

- 4 Benefits and Risks in Wealth Management

- 5 AI in Finance: Opportunities for Collaboration

- 6 Preparing for AI Adoption in the Financial Sector

- 7 Future Trends and Developments in AI in Finance

- 8 Case Studies of AI Implementation in Finance

- 9 Video: Why AI, Blockchain, and Hyper Automation are the Future of Finance (youtube.com)

- 10 Conclusion

How AI in Finance is Revolutionizing

AI has the potential to transform the financial services industry by streamlining processes, reducing costs, and improving customer experience. With the help of machine learning algorithms, AI can analyze vast amounts of data and provide valuable insights for decision-making. This has led to the automation of many tasks that were previously performed by humans, freeing up their time to focus on more complex and strategic activities.

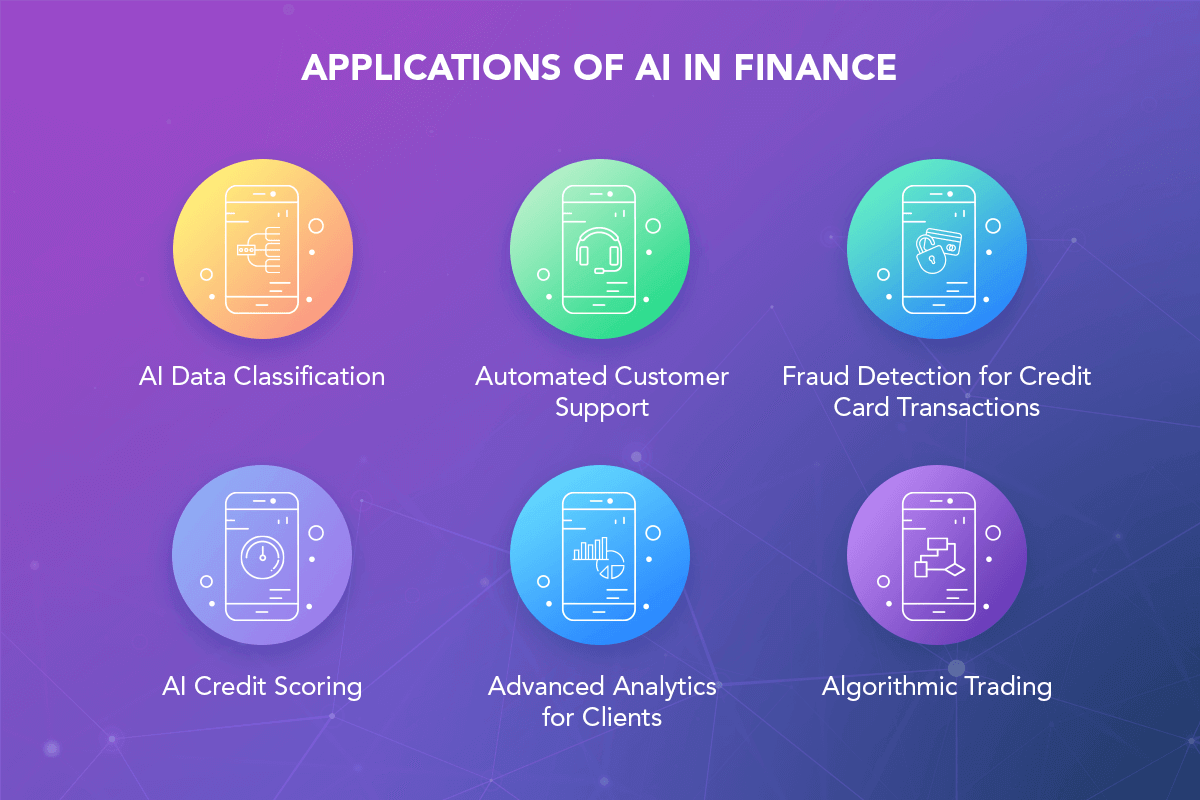

One of the main areas where AI is making a significant impact is fraud detection and prevention. Traditional methods of detecting fraud, such as rule-based systems, are no longer sufficient in today’s digital world. AI-powered fraud detection systems can analyze large volumes of data in real time, identify patterns, and flag suspicious transactions, thereby reducing the risk of financial losses for both businesses and consumers.

Another area where AI is revolutionizing financial services is in customer service. Chatbots, powered by AI, are being used by banks and financial institutions to provide 24/7 customer support. These chatbots can handle routine inquiries, such as balance inquiries and transaction history, freeing up human agents to handle more complex queries. This not only improves the overall customer experience but also reduces costs for financial institutions.

Applications Across Financial Sectors

The use of AI is not limited to just one sector in the financial industry. It is applied across various sectors, including banking, insurance, and investment management. Let’s take a closer look at how AI is being used in each of these sectors.

Banking

Banks are using AI to improve their operations and enhance customer experience. One of the main applications of AI in banking is in credit scoring. Traditional credit scoring models rely on historical data and may not accurately predict creditworthiness for individuals with little or no credit history. AI-powered credit scoring models can analyze alternative data sources, such as social media activity and online behavior, to assess credit risk and make more accurate lending decisions.

AI is also being used in customer relationship management (CRM) systems in banks. These systems can analyze customer data, such as transaction history and spending patterns, to identify potential cross-selling opportunities and personalize marketing campaigns. This not only helps banks increase revenue but also improves customer satisfaction.

Insurance

The insurance industry is also leveraging AI to streamline processes and improve efficiency. One of the main areas where AI is being used in insurance is in claims processing. AI-powered systems can analyze images and documents to verify claims and detect any fraudulent activities. This not only speeds up the claims process but also reduces the risk of fraud, saving insurance companies millions of dollars.

Another application of AI in insurance is in underwriting. AI-powered underwriting systems can analyze vast amounts of data, such as medical records and lifestyle habits, to assess risk and determine premiums. This not only reduces the time and effort required for underwriting but also leads to more accurate risk assessment.

Investment Management

AI is also transforming the investment management sector. With the help of machine learning algorithms, AI can analyze market trends and patterns to make predictions about future market movements. This not only helps investors make informed decisions but also reduces the risk of losses.

Another area where AI is making an impact in investment management is portfolio management. AI-powered systems can analyze a client’s risk profile, investment goals, and market trends to create personalized investment portfolios. This not only saves time for financial advisors but also leads to better investment outcomes for clients.

The Impact of AI on finance

The integration of AI in finance has raised concerns about the future of financial advisors. Will they be replaced by machines? The truth is, that AI is not here to replace financial advisors, but rather to augment their capabilities. By automating routine tasks, financial advisors can focus on building relationships with clients and providing personalized advice.

AI can also assist financial advisors in making more informed decisions. With access to vast amounts of data and advanced analytics, AI can provide valuable insights that can help financial advisors make better investment recommendations for their clients. This not only improves the overall quality of service but also builds trust with clients.

However, the adoption of AI in finance does require financial advisors to upskill and adapt to new technologies. They need to understand how AI works and how it can be integrated into their daily workflows. This will not only enhance their job prospects but also enable them to provide better services to their clients.

Ethical Considerations in AI-Driven Finance

As with any technology, the integration of AI in finance raises ethical considerations that need to be addressed. One of the main concerns is the potential bias in AI algorithms. AI systems are only as good as the data they are trained on. If the data used to train these systems is biased, it can lead to biased decision-making, which can have serious consequences, especially in the financial industry.

Another ethical consideration is the lack of transparency in AI algorithms. Many AI systems use complex algorithms that are difficult to interpret, making it challenging to understand how decisions are being made. This can lead to a lack of trust in AI and its applications in finance.

To address these ethical considerations, financial institutions must have proper governance and oversight mechanisms in place. This includes having diverse teams working on AI projects to ensure a variety of perspectives and avoid biased data. It also involves regularly auditing AI systems to identify any potential biases and ensure transparency in decision-making.

Benefits and Risks in Wealth Management

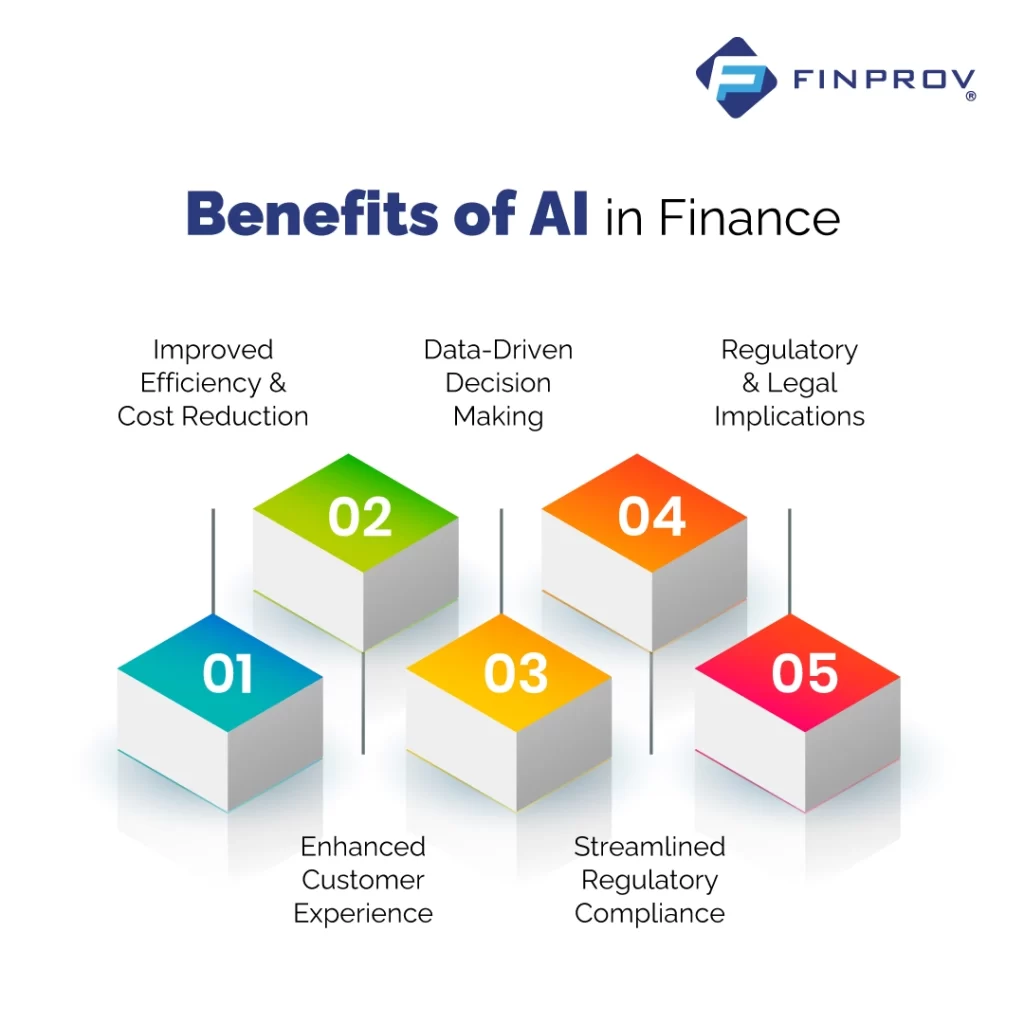

The adoption of AI in wealth management has numerous benefits, but it also comes with its fair share of risks. Let’s take a look at some of the main benefits and risks of using AI in wealth management.

Benefits

-

- Improved Efficiency: AI can automate routine tasks, such as data entry and portfolio rebalancing, freeing up time for financial advisors to focus on more complex and strategic activities.

-

- Personalization: With access to vast amounts of data, AI can create personalized investment portfolios based on a client’s risk profile and investment goals.

-

- Better Decision-Making: By analyzing market trends and patterns, AI can provide valuable insights that can assist financial advisors in making informed investment decisions.

-

- Cost Savings: The use of AI can lead to cost savings for both financial institutions and clients. By automating tasks, financial institutions can reduce operational costs, while clients can save on fees charged by financial advisors.

Risks

-

- Data Privacy and Security: With the integration of AI, financial institutions are collecting and storing vast amounts of data. This raises concerns about data privacy and security, especially in light of recent data breaches.

-

- Lack of Human Touch: While AI can provide personalized recommendations, it lacks the human touch that is essential in building relationships with clients. This can lead to a lack of trust and dissatisfaction among clients.

-

- Regulatory Compliance: The use of AI in wealth management raises questions about regulatory compliance. Financial institutions need to ensure that their AI systems comply with regulations, such as the General Data Protection Regulation (GDPR) and the Securities and Exchange Commission (SEC) guidelines.

AI in Finance: Opportunities for Collaboration

Integrating AI in finance has also opened up opportunities for collaboration between humans and machines. By working together, financial advisors and AI systems can provide better services to clients and achieve better outcomes. Let’s take a look at some of the areas where collaboration between humans and machines can be beneficial.

Risk Management

Risk management is a crucial aspect of finance, and it requires both human expertise and advanced technology. By combining the knowledge and experience of financial advisors with the analytical capabilities of AI, financial institutions can identify potential risks and take proactive measures to mitigate them.

Customer Service

As mentioned earlier, chatbots powered by AI are being used in customer service to handle routine inquiries. However, there are instances where these chatbots may not be able to address complex queries. In such cases, financial advisors can step in and provide personalized assistance to clients, thereby enhancing the overall customer experience.

Investment Decision-Making

AI can assist financial advisors in making more informed investment decisions, but the final decision still lies with the advisor. By working together, financial advisors and AI systems can analyze market trends and patterns, assess risk, and make investment recommendations that align with a client’s goals and risk profile.

Preparing for AI Adoption in the Financial Sector

The adoption of AI in the financial sector requires careful planning and preparation. Financial institutions need to have a clear understanding of their business objectives and how AI can help achieve them. They also need to consider the following factors when preparing for AI adoption:

-

- Data Quality: AI systems rely on data to make decisions. Therefore, financial institutions need to ensure that they have high-quality data that is free from biases.

-

- Infrastructure and Technology: The adoption of AI requires a robust infrastructure and advanced technology. Financial institutions need to invest in the necessary hardware and software to support AI applications.

-

- Talent and Skills: To successfully integrate AI into their operations, financial institutions need to have a team with the necessary skills and expertise. This includes data scientists, AI engineers, and business analysts.

-

- Regulatory Compliance: As mentioned earlier, the use of AI in finance raises concerns about regulatory compliance. Financial institutions need to ensure that their AI systems comply with regulations and guidelines.

Future Trends and Developments in AI in Finance

The future of AI in finance looks promising, with new developments and advancements being made every day. Some of the trends and developments we can expect to see in the coming years include:

-

- Natural Language Processing (NLP): NLP is a branch of AI that deals with the interaction between computers and human language. In finance, NLP can be used to analyze news articles, social media posts, and other unstructured data to identify market trends and sentiment.

-

- Explainable AI: As mentioned earlier, one of the main concerns with AI is the lack of transparency in decision-making. Explainable AI aims to address this issue by providing explanations for the decisions made by AI systems.

-

- Robo-Advisors: Robo-advisors are digital platforms that provide automated investment advice based on a client’s risk profile and investment goals. These platforms are gaining popularity among millennials and could potentially disrupt the traditional wealth management industry.

-

- Quantum Computing: Quantum computing has the potential to revolutionize the finance sector by processing vast amounts of data at lightning speed. This could lead to more accurate predictions and better decision-making.

Case Studies of AI Implementation in Finance

To better understand the impact of AI in finance, let’s take a look at some real-life case studies of its implementation.

JPMorgan Chase

JPMorgan Chase, one of the largest banks in the United States, has been using AI to improve its operations and enhance customer experience. The bank has developed an AI-powered virtual assistant called COiN (Contract Intelligence) that can analyze legal documents and extract key information, reducing the time and effort required for manual review. This has not only improved efficiency but also reduced costs for the bank.

Ping An Insurance

Ping An Insurance, one of the largest insurance companies in China has been using AI to streamline its claims process. The company has developed an AI-powered system that can analyze images and documents to verify claims and detect any fraudulent activities. This has led to a significant reduction in the time taken to process claims and has saved the company millions of dollars in fraud losses.

BlackRock

BlackRock, one of the largest investment management firms in the world, has been using AI to improve its investment decision-making process. The company has developed an AI-powered system called Aladdin that can analyze market trends and patterns to make predictions about future market movements. This has helped the company make more informed investment decisions, leading to better outcomes for its clients.

Video: Why AI, Blockchain, and Hyper Automation are the Future of Finance (youtube.com)

Conclusion

AI is transforming the financial industry in ways that were unimaginable just a few years ago. It is streamlining processes, improving efficiency, and enhancing customer experience. However, with great opportunities come great challenges. Integrating AI in finance raises ethical considerations, risks, and the need for collaboration between humans and machines. Financial institutions need to carefully prepare for AI adoption by ensuring data quality, investing in infrastructure and technology, and having the necessary talent and skills. As advancements continue to be made in AI, we can expect to see even more significant changes in the financial sector in the coming years.